Question: How can an Audit Committee where 2 members are:

(1) The Chairman/Founder/Largest Shareholder’s brother-in-law (Jules del Vecchio).

(2) The Chairman/Founder/Largest Shareholder’s long-time good friend, who borrowed from GMCR and never repaid (William Davis). Davis seems like a corporate entitlement/welfare recipient/beneficiary.

independently review and evaluate claims alleging accounting impropriety?

Answer: LongShortTrader believes it cannot. Del Vecchio and Davis may have qualified as “independent” by the letter of the law, but boy do they seem to have (deliberately) violated the spirit of the law.

What’s even a bigger mystery is what current CEO Larry Blanford told the Wall Street Journal yesterday:

WSJ: What is your response to the SEC’s questions about your accounting policies and Mr. Einhorn’s criticism?

Blanford: Anything like that is immediately turned over to our audit committee and they independently evaluate and review them using outside auditors and legal counsel. There have been no issues found whatsoever.

Remind me Larry: How exactly can an audit committee that includes Robert Stiller’s brother-in-law and long-time friend “independently evaluate and review” negative claims against GMCR?

“No issues found whatsoever”? Really? How come some of your restated segmented numbers still don’t add up or make no sense, as documented by Sam Antar in many posts? Why all the historical restatements? The SEC comment letters?

Larry, did anyone actually over at GMCR review and evaluate Mr. Einhorn’s concerns? How come no heads have rolled?

While, we’re at it, few more questions:

(1) Buybacks - How can you buy back $500 million in stock, when you’ve generated nearly zero cash flow from operating activities in the last several years (even as you’ve reported record breaking paper profits)?

In fact, you’ve only generated ~$160 million in combined cash flow from operating activities since 1991.

(2) Quarterly Cash Flows - What happens to your cash flows in your fiscal Q4 every fiscal year? Why is it that in every year since you’ve been with the company, Q4’s cash flows wipe out Q1-Q3’s combined cash flows ?

Given this dynamic, doesn’t this mean that year-to-date 2012 cash flow from operations as of Q3 2012 are effectively meaningless? You implied as much, when you said GMCR would not generate cash flow for the full year.

LST’s Take:

(1) GMCR cannot pay $500 million in buybacks, absent a common or convertible equity issuance. This raises the question: Why and how did GMCR authorize stock buybacks without the means to pay for it? It is LST’s opinion that the only possible explanation is GMCR wants holders not to sell, and attract others to buy.

(2) There are material accounting issues, and Q4’s cash flows, compared against the Q1-Q3s combined cash flows more accurately paints the real story. Q1-Q3’s numbers are not audited. Q4’s numbers are audited, as it is presented on a full year basis. As a result, it seems Q4’s number seems to serve as somewhat of a plug to ensure that the cash flow numbers tie in with cash balances at fiscal year end.

UPDATE I: Private Equity Firms Interested in GMCR. WILL YOU PLEASE STAND UP

Apparently there is (or was) a private equity rumor circulating earlier today…for the umpteenth time in the last few years. Remember the Radioshack buyout rumors since the stock was trading in the teens?

If you’re a private equity firm, willing to buy a company that’s generated $160 million in cash flow (before capex) over the last 20 years combined (that works out to $8 million in cash flow per year before capex), for $5 billion + please contact LongShortTrader !

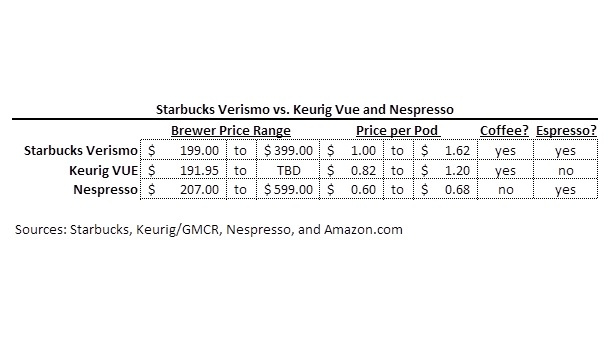

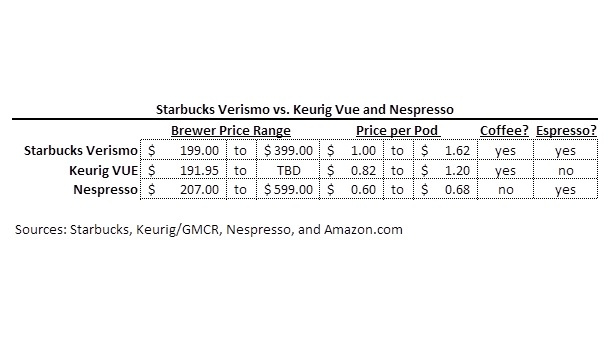

UPDATE II: Starbucks Begins Selling the Verismo, its Single Serve Espresso and Coffee Brewer, Starting Out at $199.00

The machines and capsules, are being sold online initially, will be available in some Starbucks cafes and at other retailers, including Macy’s, Williams-Sonoma, Sur La Table and Bed, Bath & Beyond beginning in October.

Source: Seattle Times - link to the story here

Here’s a quick comparison, by the #s, versus its competitors: