In late June of this year, a friend told LST to look into shorting Organovo Holdings, (“ONVO”), a “3D printing” concern. LST missed most of the move, but it nevertheless turned out to be a decent short. ONVO naturally led LST to look into the other 3D printing names as well, such as DDD and SSYS. LST avoided shorting them at the time for various reasons, including:

- There appeared to be a real underlying 3D printing growth story, though LST was not able to determine who would be the winners

- Certain growth oriented investors and promoters, who had previously (and successfully) promoted names like CMG, MAKO, BNNY, MNST, etc. were saying that DDD was the real deal, the best name among its peers, etc… so LST figured the risk of a continued parabolic move up were real

- No one mentioned the possibility of fraud or accounting issues; rather, most of the skeptical comments swirled around “overvalued”, “overextended”.

LST kept these names on the back burner…until an article critical of DDD came out this Monday (as shown):

Here’s a link to the above piece. The piece by Gray Wolf Research, “3D Systems: At the Peak of Inflated Expectations” that Douglas House refers and comes to agree with, can be found here

LST is generally not a huge fan of seeking alfalfa, but was pleasantly surprised by Douglas W. House and Gray Wolf Research’s work. Not to mention, House comes across as a very articulate, objective, responsible, respectful, and overall nice guy, based on his DDD piece (See the comments section in the piece as well; He responds with clarity and wit, even as some of his detractors do not).

Flash forward to yesterday night. DDD announced the following (after market close):

DDD announced today that it plans to hold a conference call and simultaneous webcast to discuss, fact-check and clarify several materially inaccurate statements and conclusions made in recently published articles related to various matters including its calculation of growth, accounting methods and acquisition activities on Monday, November 19, 2012, at 8:30 a.m. Eastern Time.

“We are aware of certain recent articles and their materially inaccurate and misleading conclusions. We reaffirm the accuracy of our public filings and accounting methods in all respects, and are pursuing legal remedies to hold those responsible parties accountable for what appears to be malicious, irresponsible and self-serving articles. We look forward to discussing, fact-checking and clarifying these inaccuracies for the benefit of our shareholders, customers and partners, who we believe have been irrevocably harmed by these articles,” said Abe Reichental, President and CEO of 3D Systems

While the Douglas House piece elevated LST’s interest in shorting DDD, it is the company’s unexpected response (so far) that has put the nail in the coffin. You can assume that LST will initiate a starter short position (in some form) in the coming days. Specific problems LST sees with DDD’s response:

- DDD Says it is “Pursuing Legal Remedies” - Note that the stock of companies who go after critics, and pull the legal card, tend not to fare so well. These types of companies who shoot the messenger tend to betray a guilty conscious. The response is a classic Spy the Lie* moment.

- Refers to the articles as “Malicious, irresponsible, and self-serving” - LST found the article well-intended, responsible, and not self-serving (or at least no more self-serving than DDD). LST believes the management is looking to distract and intimidate its critics. It is quite ironic that DDD is picking on one of the most even-toned skeptical pieces that LST has seen in recent memory.

- DDD does not say the claims are false - DDD skirts around the issue with sweeping statements like “We reaffirm the accuracy of our public filings and accounting methods in all respects”, or “their materially inaccurate and misleading conclusions”. Nowhere does DDD simply say the claims are false. LST sees this, too, as a poor attempt to distract.

- Why Not Simply Provide Supplementary Disclosure on all the Acquisitions - Sunshine is the best disinfectant, after all.

LST is likely going to do more work on this and related names. As of now, DDD reminds LST of the not-so-rare earth schemes, like MCP, REE, etc. back in 2011. The similarities are quite amazing. Just like the not-so-rare earth names in 2011, there is a legitimate business trend in 3D printing land. HOWEVER, the publicly traded names are probably not the best vehicles to benefit from the said trend. To make matters worse with DDD, looks, walks, and sounds more like a plain vanilla roll-up.

DDD, then, is not a valuation short: it is looking more and more like a Fad short, where the market has confused this roll-up for something it is not. LST leaves you with a list of concerns as identified in the above-mentioned pieces.

SUMMARY OF RED FLAGS

- A garden variety roll-up that is perceived to be, and promoted as, a hot growth/tech play (note that roll-ups trade at very low P/E multiples)

- Concerns that there is channel stuffing

- Issues with poor disclosure, accuracy, and quality of organic growth; that core growth is deteriorating even as the consolidated #s look fine due to acquisitions

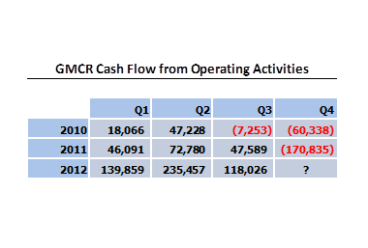

- No true earnings growth (a.k.a. free cash flow)

- Reliance on capital markets for growth; DDD needs the market, the market doesn’t need DDD

- R&D underinvestment relative to competitors, which isn’t exactly what you find in true growth names

- Downgraded auditors back in 2003, from a big four firm to a more regional one (went from Deloitte to BDO)

- Most recent acquisitions’ year over year growth over comparable 9 month period (Z-corp and Vidar) is flat

- Management says revenue from “The Cube” will be immaterial for the rest of the year