I’m writing this so I can look back and understand what was happening at this period in time. The markets humble all. The markets humble me. Some of my best trades have gone meaningfully against me before paying off handsomely. Other times trades have gone against me…and they just continued to go against me.

I don’t think anyone fully knows what is driving the (statistically significant) decline in risk asset prices world-wide. Some blame the Federal Reserve’s ‘raise’ (despite the fact that rates have actually only declined since). Others blame oil/commodities. Others blame the Sovereign Wealth Funds of these commodities-dependent countries. Yet others blame China currency, and China “macro”. Some have pointed out the European bail-ins. And then there are those who simply attribute it to “cycles”. (even wilder, are the Saudis want it, conspiracy theories).

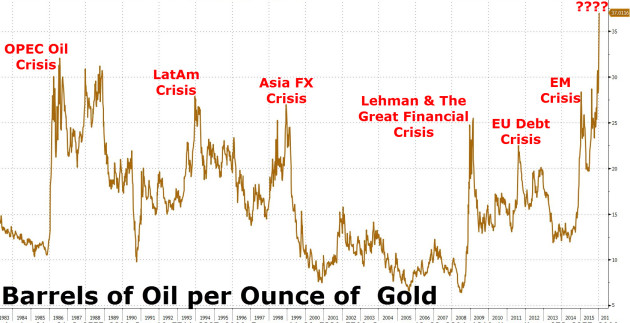

I don’t know the answer. I do know, however, that the following is a FACT (not opinion): the current decline in oil prices (crude oil spot,as of intraday low for today), from peak to trough, is around -75%…that is the worst decline in history. The other comparable declines (both in the -70% territory) occurred in the 1980s and 2008-2009 respectively. This decline has exceeded both of those prior declines. We are in unchartered territory.

Here’s another fact: the decline in overall risk asset prices since January 1, 2016, has coincided with the accelerated decline of oil prices.

Now, I am not smart nor informed enough to understand nor articulate causation: why are oil prices down? why are they down so much? Some say it’s all supply, specifically pointing to the US shale boom (energy independence!). Or Iran supply. Others point to demand weakening, or anticipated demand weakening, e.g. China (China constructed more blah blah blah than the world has ever seen). Then there’s the credit element to all this. And the strong USD. Again, I don’t know. All I know is whatever serious (or not so serious) supply/demand problems exist, the market is very LOUDLY - in the form of the -75% decline - reflecting that yes, there are some serious problems. Serious problems lead to historical price declines.

Yet another fact: risk asset prices declined - somewhat indiscriminately - in the “correlation -> 1” fashion. It’s as if there were only 2 trades: You’re either long risk assets, or short risk assets (okay fine: you might be fully in cash). Why? again, I don’t know…but I do know that risk assets have historically tended to move together when there is forced selling, market panic, and/or climactic anticipation of some major event.

Which leads me to…

Putting all the above facts together: I can only reasonably conclude that the risk markets are demanding something from the oil complex. Risk assets want a sacrificial lamb as substitutionary atonement. Risk assets don’t care that the intrinsic value of some companies are actually RISING with lower oil prices. No, the market seems obsessed with the fact that the lower the oil prices go, the closer/faster that the intrinsic value of the equity of many of these oil companies -> zero. Market prices don’t merely reflect reality..they alter them too. In fact, perhaps 30-40% of these equities are already intrinsic zeroes. But we have yet to see a major casualty. Let’s suppose that there were a major casualty today/this week/YTD, or several casualties. You generally don’t hear about them at the lows… you tend to hear about them several days/weeks afterward.

We may experience violent bounces (as they say, the worse things get, the less it takes to turn things around), even without a major episodic casualty. but it seems that given all the above facts/conditions the markets need a sacrificial lamb before “bottoming” for good.

The alternative is that risk assets need another narrative to replace the oil one.