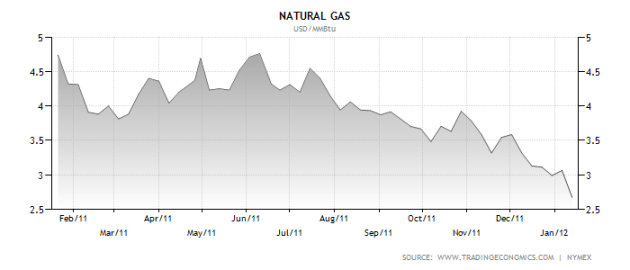

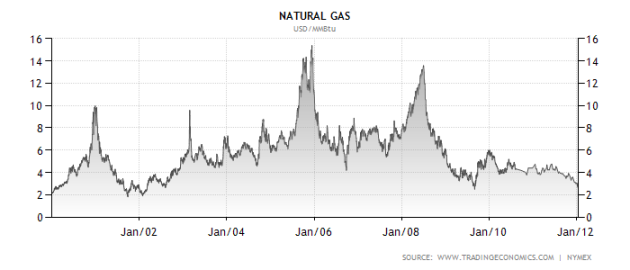

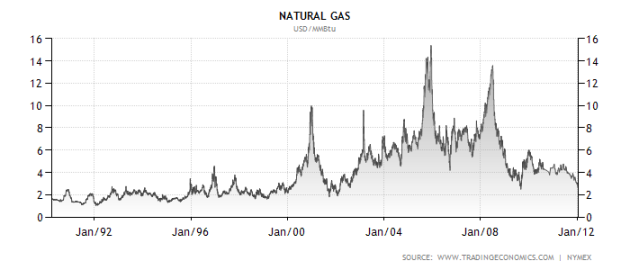

Natural Gas: What Is The Case For NOT Going Long Right Now at $2.30?

January 20, 2012 Leave a comment

@toglesby27 wrote: Winter stays mild

@andrew_falde wrote: Global warming 😉

Supply/Capacity Related - In addition to weather, and therefore, consumption/demand related problems, there seems to be a excess supply/inventory issue. As a friend of mine told me: “The case against (going long nat gas) is eleventy billion companies digging holes in shale and increasing supply like crazy - all while we’re having a warm winter”.

Here’s what a few tweeps specifically said:

@cfinal wrote: inventories at this point highest in past 10 yrs…even if temps go back to avg…too much gas… Marcellus shale field is producing more and more gas…la Nina effect no longer expected so summer shouldn’t be as hot. they don’t call #ng widow maker for nothing…haha

@lcsonka39 wrote: producers ‘can’t’ shut in / summer weather in january. status quo. i hear ya but its been 1 way train 4yrs now.

@gavparks wrote: Talked to a friend in the industry tonight - demand is simply not there… This is knife catching territory short term IMO

Other Factors: Some responses were interesting, as they addressed fear of margin call (if one were to presumably buy futures contract), big oil/political considerations, and possible additional selling pressure from forced institutional selling, a la Amaranth. There was also the most obvious reason, that it’s in a bear market,

Here’s what the tweeps who contributed these other factors wrote:

@amb5160 wrote: fear of margin calls

@volslinger wrote: big oil lobbyists have politicians in their pockets Natty won’t get fair shake at providing our well needed oil dependence

@matterhornbob wrote: That the right questions…this is a MASSIVE liquidation of “interest” across the board, with some gigantic losses

@rexblazer28 wrote: nasty snarling angry bear market… due for a huge bounce at some point. you don’t wanna need that bounce to get back even

Sentiment: I got the impression everyone is highly curious about sentiment. For example, @inelegantinvest wrote: “So what’s the consensus. It looks crazy cheap to me, but then, I’ve thought so for 2 years.” and @milktrader wrote: “what sentiment are you gathering?” The sentiment seemed overwhelmingly negative.

How to Play: I may follow-up with a post outlining the case for going long. For now, it seems the purest ways to play would be via the various futures and futures options contracts. @specialsin had the same questions I had, and was wondering which instruments to use. A few tweeps responded:

@chrispycrunch wrote: Try $CHK for leveraged nat long, devon energy, and LINE, an MLP for income

@mojoris1977 wrote: what is the variant view on natty other than its lower? Have we seen a capitulation yet? Have a look a VQ

I took look at a few of these alternative ways to play nat gas… I have my opinions, but will keep to myself for now.

When I am looking to buy, I’ve been trying to make a habit of fully understanding and respecting the bear case before going long, especially if the idea looks like a falling knife. At this point in time, I don’t fully understand the bear case. Said differently, I don’t see why nat gas cannot visit the $1.00 handle. I’d like to fully understand how and why nat gas could fall to, say $1.50.

@Csicsko wrote: It’s not at $0.00, yet. j/k

@Mortiman wrote: Cattle seems more enticing

@DaniChicarito wrote: can’t go any lower… haha

@SamQuint1 wrote: not a clue……