2016 and The Limitations of Contrarianism

January 16, 2016 Leave a comment

I find writing immensely therapeutic. and after the last two weeks of banging my head against the wall on a daily basis, I really could use some therapy. Writing may even help me recover from the brain-damage resulting from all this head-banging.

I’ve always had the (un)natural tendency to do or think the opposite of what others think or do. I’ve tended to be contrarian before I even knew the word existed.

What I learned over the years, regarding contrarianism for the purpose of investment/trading:

- It often leads to losing $ (i.e. “permanent capital impairment”). See oil equity longs circa 12 months ago, and ever since.

- It tends to be a necessary (but insufficient) characteristic for my best trades (ever)

- measurement of contrarianism/crowding can be highly valuable…or garbage-in, garbage-out.

- It is a lonely place to be. Not where you go to make friends.

So I would like to point out a few facts, for my own and posterity’s edification:

- Many members of The Street/Sellside have been fairly bearish since the end of last year/beginning of this year.

- Sentiment measures/indicators have been negative.

- Some measures of positioning have been fairly bearish.

- Gartman has been as right as he’s been wrong.

- Harry Dent is looking like a genius.

- CNBC “markets in turmoil”

- “2008” and “crash” have been mentioned far more frequently than normal

All the above preceded - yes, preceded - further declines in US equities. If one possessed a Niederhofferian faith in the validity of such signals and contra-signals, and followed the natural course of reasoning and therefore bet in the other direction, one would be down more than -10% YTD. The path to blowing up.

Looking forward, the following complicate matters further:

On one hand,

- a certain levered long operator (posing as a hedge fund) who seems to have a penchant for blaming quants/HFTs/the boogeyman anytime his fund is down, goes on TV to tell the world he is.. <drumroll> bullish

- Whitney Tilson, a fan favorite, expressing bullishness.

On the other hand,

- AAII Sentiment

- other sentiment indicators, e.g. put/call, etc (something something since Lehman).

- Markets in Turmoil

- Mainstream nightly news

- “2008” and “crash” continue being mentioned far more frequently than normal

- “funds running net shorts this week surpassed 20%, only 3rd time over last 10 years (prior GFC ’08 and European Sovereign Crisis ’11).”

Some food for thought:

- A certain macro hf mgr earned enough (unclear if realized or not) just in the last 1-2 weeks (on bearish bets), to wipe out his entire 2015 double digit losses. Another hf mgr (one of the best performing last year), is up half of what they were up in 2015….in the first 2 weeks of 2016.

- Some funds (the ones that were down -20% or more) probably stand at a knife’s edge… I think it will be difficult for them if market correction this year goes beyond 10-20%. Beyond down 30-40% is very difficult to recover from. -40-50% is (arguably) escape velocity.

- 2 weeks of 2016 feel like 4-6ish months of most years. I believe my ‘feeling’ squares with statistics. it is with merit.

- There’s only one person I know (personally) who got the recent price movement(s) right for the reasons… he’s the only one who alerted to look toward China back in November/Draghi, while all eyes were on Draghi/Yellen… even better, he ex ante explained the mechanism by which x -> y -> z… what’s amazing is even after these moves, I’ve seen NO ONE explain the mechanisms!

- I need to (resume) reading more 10Ks.

- I mentioned the word ‘bifurcation’ weeks before the new year. I see more people (via different analytical methods) coming to same conclusions now. Unfortunately, I don’t think there’s been any resolution yet. The only thing that has changed is that risk assets are currently priced lower.

- There’s one area in markets (I think only?) where I see price momentum…and signs of parabolic rise. I love parabolas.

- Perhaps widespread confusion may be best explained by a rather simple observation: one chapter ended , and we’re now in a new chapter. No one really knows the rules of this chapter…but what we do know is that those who best exploited the “rules of the game” of the prior chapter are the ones experiencing greatest pain and confusion. I can think of at least 3 different types of market operators/strategies that fit the bill.

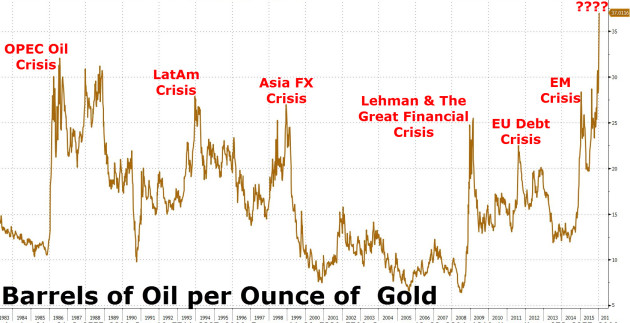

Here is a chart to think about (courtesy of my friends at zerohedge):