At What Price Might Diamond Foods be Cheap?

February 9, 2012 Leave a comment

As those who follow me on twitter and those who I speak to privately are aware, I’ve been bearish on Diamond Foods (DMND) since Q3/Q4 of 2011. I’ve been in and out of shorting the stock. Earlier today, DMND announced the following:

(1) its audit committee found that the company would need to restate its fiscal year 2010 and 2011 results as it had improperly accounted for payments to walnut growers.

(2) DMND CEO and CFO have been placed on leave.

(3) Diamond named its director Rick Wolford as acting Chief Executive replacing Michael Mendes, and said Michael Murphy of Alix Partners would serve as acting finance chief in place of Steven Neil. Note that Alix partners is known for its work in the corporate turnaround and restructuring industry (‘restructuring’ is often a euphemism for bankruptcy).

The news and subsequent stock price action is not surprising to me; in fact, I asked several people the last few months: what happens if the CEO/CFO resign? Or if DMND has to restate its financials?

As the shorts’ thesis plays out, the question for longs and shorts remain: where’s the bottom (or is there one)?

Jason Merriam, whose work + opinions I had respected until he wrote some positive reports on DMND and GMCR recently, wrote “Diamond Foods: Chopped Nuts On The Cheap” on January 16, 2012. http://seekingalpha.com/article/319824-diamond-foods-chopped-nuts-on-the-cheap

I wrote the following in the comments section (I am SilverLeaf):

“You realize that if the accounting allegations are correct, DMND 2011 EPS is roughly cut in half, to something like $1.20/share ? You slap on a generous average S&P 500 multiple, and the stock looks quite rich at current market prices. As a result, buyers (such as yourself), seem tempted by the fact the shares are down. They’re not cheap…not by far.

I would be buyer as well, but much lower. This btw, does not factor in the DOJ’s criminal probe.

Just look at how chinese reverse merger stocks traded (valuation wise)…those were dirt cheap..and got cheaper and cheaper. Nearly none of those were subject to DOJ investigations. “ - Me, January 16, 2012

“In short, your argument/rhetoric above is weak at current prices…but would be compelling for much lower. There are businesses like RIMM (Blackberry) that are cheaper than DMND, by far.” - Me, January 16, 2012

Jason responded:

“SilverLeaf, Thanks for the comments. Clearly, the risk of a restatement is elevated, but it would likely be a non-cash hit to equity rather than a material change in cash-flow.

As for valuation, I don’t know that an average multiple of the S&P 500 is a representative comparison to/for DMND per se, but I agree that a significant whack to eps could make shares look pricey from a P/E perspective.

It’s what we see in the cash-flow components of earnings however, which lead us to believe there is some value in the shares at current levels.

I won’t speculate as to whether RIMM is less expensive (suggested in your second reply), but would submit that both stocks are cheap and for different reasons. In fact, I recently wrote a piece on RIMM you may find of interest.”

My take: If DMND trades in the teens, I may take a look at it as a long. Even then, there is downside risk to the stock (what do you think I’m hinting by the fact that Alix Partners is somehow involved; also, see its balance sheet and tangible book value). ::UPDATE:: I was going to write my reasons below, but John Hempton, of Bronte Capital (that bastard!) beat me to it, so I will link, and copy/paste what he wrote:

http://brontecapital.blogspot.com/2012/02/diamond-foods-what-press-releases-says.html

Diamond Foods What The Press Release Says and Does Not Say

Diamond Foods is a short-battle-ground stock. Anyone who looks at Herb Greenberg’s twitter feed can see that. Herb loves battlegrounds.

Today the company made a repetitive press release that has me reading between the lines. Here is the guts of the release:

[The company] today announced that the Audit Committee of its Board of Directors has substantially completed its investigation of the Company’s accounting for certain crop payments to walnut growers. The Audit Committee has concluded that the Company’s financial statements for the fiscal years 2010 and 2011 will need to be restated. Over the course of the last three months, the Audit Committee has carefully reviewed the accounting treatment of certain payments to walnut growers. The Audit Committee has concluded that a “continuity” payment made to growers in August 2010 of approximately $20 million and a “momentum” payment made to growers in September 2011 of approximately $60 million were not accounted for in the correct periods, and the Audit Committee identified material weaknesses in the Company’s internal control over financial reporting.

The Board of Directors is taking a number of corrective actions including the appointment of a new Chief Executive Officer and Chief Financial Officer. Effective immediately, the Board has appointed Director Rick Wolford to serve as Acting President and Chief Executive Officer and Michael Murphy, of Alix Partners, LLP, to serve as Acting Chief Financial Officer. The Company is commencing searches for permanent replacements for the CEO and CFO positions. The Board has also appointed Robert J. Zollars, who previously served as Lead Independent Director, to the position of Chairman of the Board. Michael J. Mendes and Steven M. Neil have been placed on administrative leave from the Company.

I have read the whole release - but there is no additional information.

I know relatively little about this company - indeed I did not bother looking because the short was crowded and the product (Kettle chips and walnuts) seemed OK. But this release had me puzzled.

The offence as described - moving $20 million of expense from one year to another in one year and $60 million in another year seems relatively minor. But the sacking of the CEO and CFO and the appointment of Alix Partners seemed less minor.

Still timing offences (and they admit timing offences) must be measured relative to earnings.

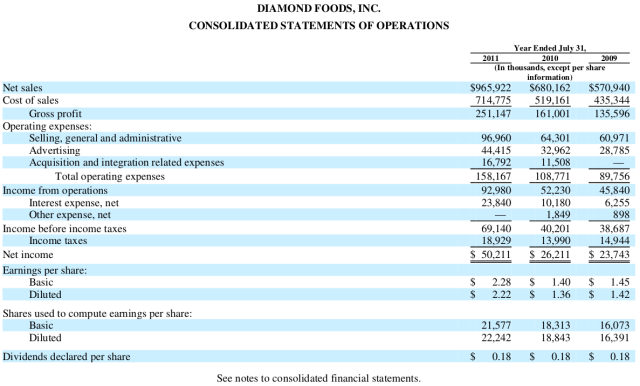

The last 10K (since amended and now withdrawn) shows nicely growing income in excess of $50 million.

$26 million in net income and about $50 million in the next year. If you were to add $20 million of expense to 2010 and $40 million (the net amount moved) to 2011 and tax-effect those amounts the profits drop from a net $26 million to $14 million for 2010 and $50 million to $22 million for 2011.

That is pretty nasty. But not terminal. Still there are 21 million shares outstanding and at the after-market price ($21 down 42 percent) that is still 20 times earnings.

It does not look like a salivating buy at 20 times. Not close.

And the loss of the CEO and CFO does matter. There is seldom only one cockroach.

The thing that gets me though is the appointment of the new CFO. Michael Murphy is from Alix Partners and his CV makes it very clear that he specializes in restructuring debt. Alix do a lot of bankruptcy work (though that is not the only thing they do).

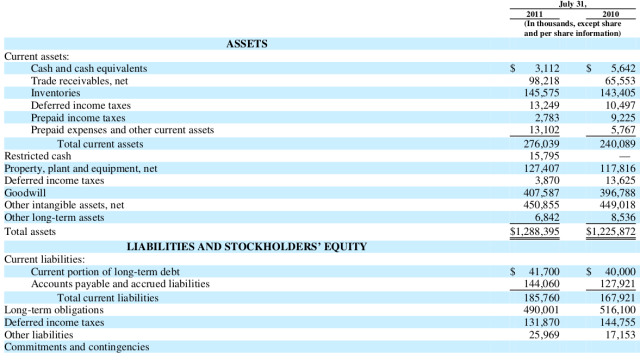

The last balance sheet (also since withdrawn) is amusing.

It shows cash of just over $3 million, some short term debt and long term obligations of nearly half a billion dollars. And - given the restatement - we can guess this thing only earns just over $20 million a year - and even that presumes the absence of further cockroaches.

I shorted some in the after-market. Don’t do that often - but am quite pleased with myself.

UPDATE 2012 02 09 11:20 PM EST

“P&G to Terminate Pringles Sale to Diamond”